Kolkata, India

- Address : 36 Ballygunge Gardens, Kolkata - 700019

- Contact No : +91 8777076816

- Support No : +91 8918796420

- Email : info@sbcreationgroup.com

DSA Loan Management Software is a specialized solution designed to streamline and automate the various stages of loan origination, processing, and servicing for direct selling agents. It serves as a centralized platform where DSAs can efficiently manage loan applications, documentation, customer relationships, credit assessments, compliance requirements, and payment processing. By integrating these functionalities into a cohesive system, DSA Loan Management Software authorises DSAs to provide superior service to borrowers while enabling lenders to optimize their operations smoothly.

DSA Loan Management Software facilitates end-to-end management of loan applications, from initial submission to final approval or rejection. DSAs can input and track application details, including borrower information, loan amount, purpose, and supporting documents. Automated workflows guide applications through various stages, ensuring timely processing and minimizing manual intervention.

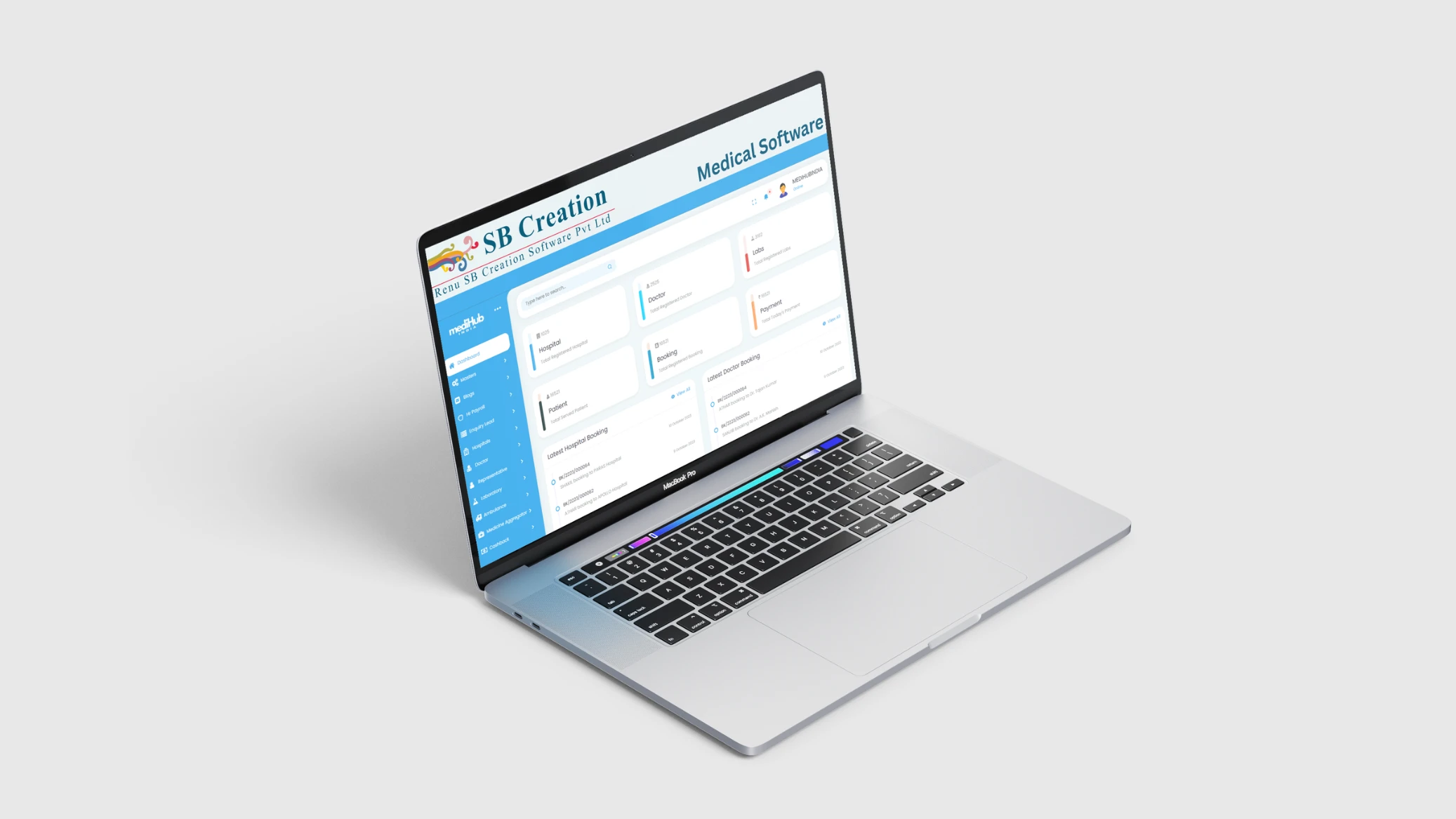

We at Renu SB Creation Software Pvt Ltd have been providing the Best DSA Loan Management Software solutions for more than 19+ years and have been awarded as “One of the Best IT Companies” by the Ministry of Education, Govt of India. We can even design the Loan DSA Software according to your preference, which means you can have access to the customizable software option.Still doubtful? Request a Free Demo today to learn how our Loan Direct Selling Software (DSA Loan Software) can transform your operations with automation and reduce human error to nearly zero.

Loan Application Management

Loan Application Management

Document Management

Document Management

Customer Relationship Management (CRM)

Customer Relationship Management (CRM)

Credit Scoring and Risk Assessment

Credit Scoring and Risk Assessment

Loan Processing Workflow

Loan Processing Workflow

Security and Data Protection

Security and Data Protection

Integration Capabilities

Integration Capabilities

Reporting and Analytics

Reporting and Analytics

Payment Processing

Payment Processing

Compliance and Regulatory Reporting

Compliance and Regulatory Reporting

Workflow Automation

Workflow Automation

Loan Product Configuration

Loan Product Configuration

Collateral Management

Collateral Management

Communication Tools

Communication Tools

Audit Trail and Logging

Audit Trail and Logging

Loan application management

Loan application management

Document management

Document management

Customer relationship management (CRM)

Customer relationship management (CRM)

Credit scoring and risk assessment

Credit scoring and risk assessment

Loan processing workflow

Loan processing workflow

Compliance and regulatory reporting

Compliance and regulatory reporting

Payment processing

Payment processing

Reporting and analytics

Reporting and analytics

Integration capabilities

Integration capabilities

Provides performance analytics

Provides performance analytics

Streamlines communication channels

Streamlines communication channels

Monitors repayment schedules

Monitors repayment schedules

Easy document uploads

Easy document uploads

Customizable loan workflows

Customizable loan workflows

Supports multi-bank integration

Supports multi-bank integration

Reduces paperwork hassle

Reduces paperwork hassle

Enhances loan tracking

Enhances loan tracking

Ensures data accuracy

Ensures data accuracy

Real-time status updates

Real-time status updates

Improves agent productivity

Improves agent productivity

Automates loan disbursement

Automates loan disbursement

Tracks leads efficiently

Tracks leads efficiently

Manages customer data

Manages customer data

Simplifies loan processing

Simplifies loan processing